Economic Update June 2024

The highlights:

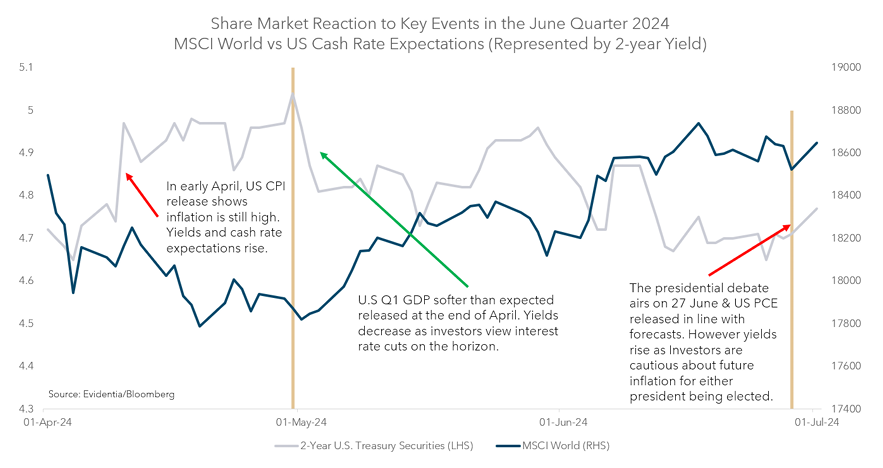

The first half of 2024 wrapped up on a positive note with signs the United States (US) economy remains on track for the soft landing, fuelling investor optimism in June. US inflation continued to moderate in May, strengthening expectations the US Federal Reserve (Fed) will reduce rates this year.

Following the first US presidential debate, odds firmed about a potential second term for former President Trump, causing a late-June spike in bond yields. Trump’s policies are considered inflationary, which has the potential to create short-term uncertainty for markets.

International shares continued to rise in June as the unrelenting AI mega-tech rally rolled on. US shares enjoyed another strong month, while Australian shares also posted gains.

Returns from fixed interest markets were positive in June as bond yields edged lower following reports of cooling US growth and inflation. Higher relative income meant credit outperformed long duration government bonds.

Market observations & outlook

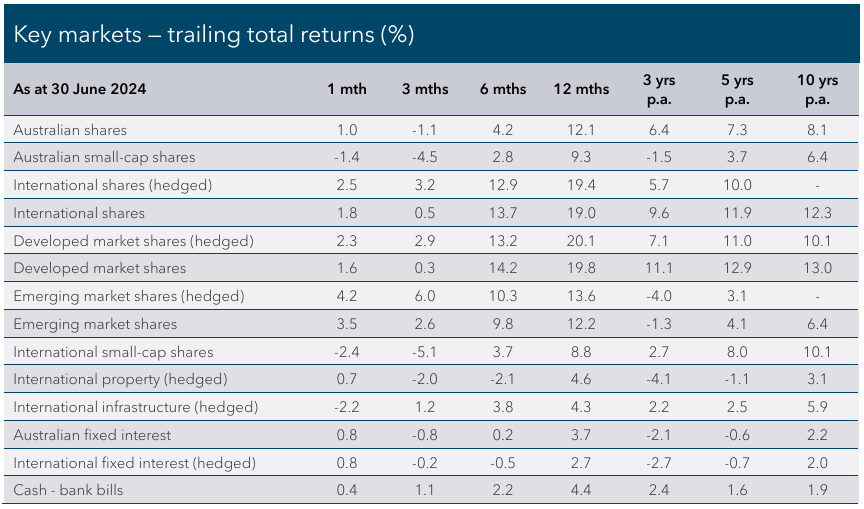

Global share markets shrugged off a weaker April to post solid gains in May and June and end the quarter on a high note following the release of more accommodative ination and economic data in early May. Returns from US and Asian markets were particularly strong.

However, narrow market leadership remains a recurring theme, particularly in the US. Gains were again dominated by Nvidia and a handful of other mega-tech companies riding the momentum created by generative AI. This trend has persisted over the past 18 months, leading to an increasingly concentrated US market, with these companies taking up a larger portion of total market capitalisation. The information technology and communication services sectors accounted for virtually all US gains in the June quarter. The so-called ‘Magnicent 7’ companies currently have a combined weight equal to 30% of the S&P 500 Index.

Fears of persistent Inflation, which spiked in April, have continued to moderate, providing relief for markets throughout the remainder of the quarter. Our view is that US inflation's current trajectory and composition remain favourable for markets. Expectations for rate cuts further support this positive outlook. Share market valuations — which have continued to stretch upward — remain our biggest concern. However, we are mindful that markets can remain expensive for a long time.

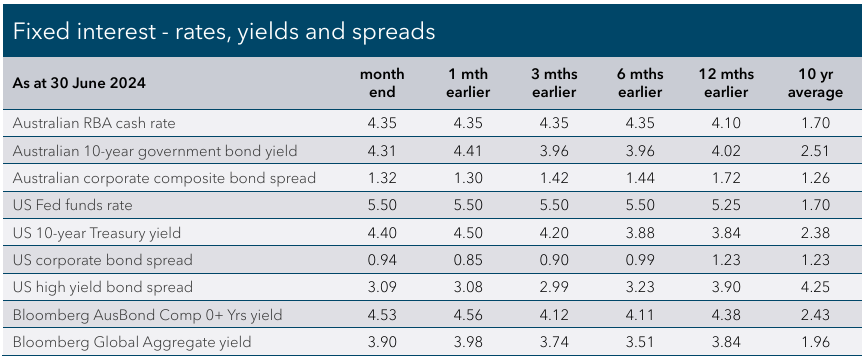

Market pricing suggests that the Fed may implement one or two rate cuts by the end of 2024 and into 2025. In contrast, the RBA is expected to maintain the cash rate close to current levels for the next 12 months — both markets are expecting rates to be around 4.3% this time next year. Although the rate-cutting cycle is near, higher interest rates appear to be here to stay. Large government deficits and de-globalisation are likely to keep rates higher than pre-COVID levels.

Investor attention on the upcoming US election and its potential impact on markets intensified in late June. US bond yields jumped following an underwhelming performance by President Biden in the first presidential debate, which led investors to anticipate the possibility of a second term for former President Trump. Trump's policies to reduce immigration, increase tariffs, and provide tax cuts (both individual and corporate) are all inflationary and could influence market dynamics in the short term. Additionally, neither candidate demonstrated a strong commitment to cutting government spending or reducing national debt.

Economic Review

Australia

Inflation surprised to the upside again in May. Annual core consumer price index (CPI) inflation jumped 4.4%, up from 4.1% in April and exceeding market estimates. Following the report, markets moved to price out any chance of a rate cut this year, with the odds improving on the potential for a rate hike.

Earlier in June, the RBA left the cash rate unchanged at 4.35% but reiterated it was “not ruling anything in or out” regarding its next move. The slower-than expected decline in inflation means the case for a rate hike remains on the table. Any move will depend on the outcome of the more comprehensive June quarter CPI report released at the end of July.

Australia’s tight labour market continues to ease. Unemployment rose to 4.0% in May, increasing from a revised 3.9% in April. Job advertisements fell for a fifth consecutive month in June. Australian households, continuing to do it tough, will receive some relief in the form of income tax cuts and energy rebates that take effect in July.

US

Retreating inflation, slowing consumer spending, and softening labour conditions strengthened the case for a Fed rate cut in September. Annual core CPI was 3.4% for May, lower than the estimated 3.5%. Core personal consumption expenditures (PCE) price Index — the Fed’s preferred measure of inflation — retreated to 2.6% in May. The unemployment rate hit a 2½-year high of 4.1% in June, pointing to a slackening labour market.

The Fed left rates on hold at 5.25–5.50% at its June meeting, updating its projections to imply one rate cut in 2024. Chair Jerome Powell maintained that although recent inflation readings have been positive, the Fed “will need to see more good data to bolster our confidence that inflation is moving sustainably toward two per cent.”

Europe

Core annual inflation is expected to be 2.9% in June, unchanged from May. After lowering rates in June, the European Central Bank (ECB) indicated it’s waiting for more evidence inflation is firmly on a path to its 2% target before considering further cuts. Regional political uncertainty, including a snap French election that saw a victory for left-wing parties and deteriorating economic relations with China over tariffs on electric vehicle imports, are potential headwinds for European economic recovery.

The United Kingdom (UK) economy is grinding into gear. After a technical recession in the second half of 2023, gross domestic product (GDP) growth rebounded 0.7% in the first quarter of 2024. Annual core CPI rose by 3.5% in May, down from 3.9% in April. The Bank of England (BoE) left rates on hold at 5.25% in June, but markets pricing in a rate cut in August.

Asia

In Japan, annual core CPI ination rose 2.5% in May. This was up from the 2.2% recorded in April and above the Bank of Japan’s (BoJ) 2% target leaving open the possibility of a rate hike in July. Further deprecation in the yen has heightened the possibility of an upward revision to the BoJ’s inflation forecasts and support for a hike. However, an unexpected GDP downgrade for the March quarter will probably force the BoJ to cut its growth forecasts, complicating any future decision.

The People’s Bank of China (PBoC) left its one-year loan prime rate (LPR) — its key loan lending rate for corporates and households — unchanged at 3.45% in May amid calls for a cut to stimulate loan demand and aid China’s sluggish economic recovery. Recent government stimulus has had little immediate impact on the struggling housing market as prices continued to decline. On a positive note, retail sales rose in May, beating forecasts.

Asset Class Review

Australian Shares

Australian shares climbed higher for the second consecutive month in June but lost momentum over the quarter as the underperforming resource sector and concerns about the interest rate outlook weighed on returns. The broader S&P/ASX 200 Index advanced +1.0% for the month but retreated -1.1% for the quarter. More sensitive to higher interest rate rates, small companies lagged their larger peers, with the S&P/ASX Small Ordinaries Index giving back -1.4% and -4.5% over the month and quarter.

Sector performance was largely positive in June. Financials (+5.1%) surged ahead as shares in the ‘Big Four’ banks hit multi-year highs on the back of easing recession fears and raised earnings estimates. The highly concentrated utilities (+4.6%) sector was boosted by a strong month for several sector heavyweights. The recent resurgence in global biotechnology company CSL helped boost the health care (+4.4%) sector, while consumer staples (+4.6%) was stronger as investors favoured the defensive supermarkets, which are less likely to be impacted by the cost-of living pressures being felt by Australian households. Materials (-6.5%) saw the biggest falls in June, with underwhelming economic data out of China pointing to weaker demand for commodities. Sector performance was mixed over the quarter. Utilities (+13.3 %) was the clear winner, followed by financials (+4.0%) and information technology (+2.9%). Conversely, energy (-6.8%) struggled as oil prices drifted lower on OPEC+ supply increases. Weakness in June pulled materials (-5.9%) down for the quarter, while the interest rate-sensitive real estate (-6.0%) sector also retreated.

What fund managers are saying…

“The Australian consumer has endured the rate hiking cycle with surprisingly good health. But how much longer can consumers withstand the squeeze?

While, according to headline figures, employment remains robust, there is more behind these numbers. Anecdotally, many companies burnt by labour shortages post-COVID are reluctant to let employees go. This labour ‘hoarding’ can only be upheld if business conditions don’t worsen.

Savings buffers have been drawn down. AMP analysis indicates that the bottom 40% of households by income have already exhausted their excess savings, while high-income earners are sitting on a significant surplus. This is an important distinction as we know higher income earners have less propensity to spend their savings. And the longer interest rates remain high, cost-of-living pressures eat further into household budgets.

It is also clear that the likelihood of multiple interest rate cuts this year is low. Inflation is stickier than expected, especially in core, essential service categories such as housing, transport, education, insurance and financial services. These categories represent almost half of the CPI basket and are seeing high, and in some cases, rising levels of inflation. Finally, immigration is also being curtailed.

Australian consumers have been resilient, but time is running out.“

Fidelity International

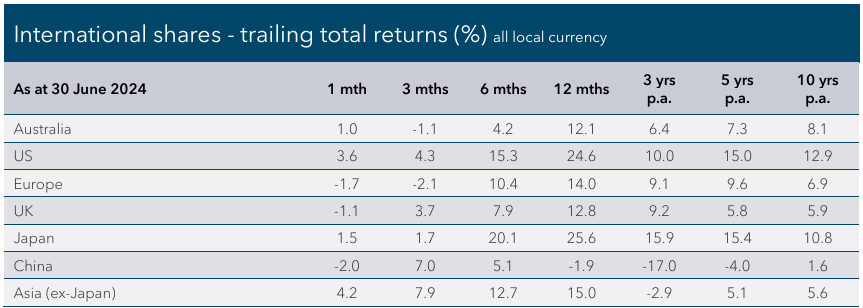

International Shares

International share markets extended gains in June as the ongoing US mega-tech rally and positive sentiment created by positive US inflation data boosted index returns. The MSCI All Country World Hedged Index increased +2.5% in June and +3.2% for the quarter. Returns from unhedged shares faced the headwind of a stronger Australian dollar, gaining +1.8% and +0.5% over the month and quarter. Despite the positive moves, a significant portion of those gains were concentrated in only a handful of the index’s biggest companies, leaving the rest of the market behind. Global small companies endured a difficult period, with the MSCI World ex Australia Small Cap Net Return AUD Index declining -2.4% in June and -5.1% over the quarter.

Sector performance was mixed over the month. Unsurprisingly, information technology (+8.9%) and communication services (+4.3%) dominated — AI chip maker Nvidia briefly became the world’s most valuable company. The recent rally in utilities (-4.5%) reversed in June, while materials (-3.5%) and energy (-1.7%) also went backwards. It was a similar story over the quarter, with information technology (+11.7%) and communication services (+8.4%) the standout sectors.

Led by the mega-tech rally, US shares extended their gains. The S&P 500 Index rose +3.6% in June and +4.3% over the quarter, while the tech-heavy Nasdaq Composite Index outperformed as expected, climbing +6.0% and +8.5%. The Euro Stoxx 50 Index — which tracks the performance of the European region’s 50 most influential companies — fell by -1.7% for the month and -2.1% for the quarter. This decline was driven by uncertainty surrounding the announcement of parliamentary elections in France and diminishing expectations for aggressive interest rate cuts. The UK’s FTSE 100 Index also retreated in June, down -1.1%, but enjoyed a strong quarter, advancing +3.7% and hitting fresh all-time highs in the process.

Japanese shares maintained momentum as the Topix Total Return Index gained +1.5% and +1.7% after a better than-expected full-year earnings season. The MSCI Emerging Markets Index (Hedged) finished ahead of developed markets over the month and quarter, increasing +4.2% and +6.0%. Emerging markets were boosted by strong quarterly gains from Chinese shares — the MSCI China Net Total Return Index was up +7.0% — and the AI-exposed Taiwanese market.

What fund managers are saying…

“The expansion in US GDP, while slowing, is still firm. Unemployment rates are historically low, and corporate profit margins are high. Household and business finances are strong due to the deleveraging during the pandemic recovery, creating some cushion in case the slowdown accelerates. As is common in the later stages of the economic cycle, stock valuations are elevated, and risk premiums — the investment returns that assets are expected to yield above their risk-free rate of return — are low. That’s balanced, to some extent, by the S&P 500’s return on equity, which is among the highest it’s been in more than a century. From that perspective, the valuations are high, but we’re not really taking it as a reason to be extra bearish.”

Goldman Sachs Asset Management

Property and Infrastructure

Global listed infrastructure fell in June but posted solid quarterly gains — the FTSE Global Core Infrastructure 50/50 (Hedged) Index was down -2.2% for the month and up +1.2% for the quarter. US Treasury yields edged lower in June but drifted higher over the course of the quarter, which explained the moves in the rate-sensitive global listed property sector, with the FTSE EPRA Nareit Developed Index (Hedged) lifting +0.7% over the month but retreating -2.0% over the quarter.

Fixed Interest

Fixed interest markets generated positive returns in June as government bond yields edged lower for a second straight month. Both the Bloomberg Global Aggregate Bond Hedged Index and the local Bloomberg AusBond Composite 0+ Yr Index advanced +0.8%. However, gains in May and June were not enough to offset the losses experienced in April when bond yields spiked on renewed concerns about US inflation and the timing of interest rate cuts. Over the quarter, global bonds retreated -0.2%, while Australian bonds fared worse, falling -0.8%.

US Treasury yields edged lower in June following reports of cooling US growth and inflation that raised hopes of rate cuts but moved higher over the quarter. The 10-year US Treasury yield declined -0.10% in June to 4.40% but increased +0.20% over the quarter. The local bond market followed the same pattern. 10-Year Australian Government yields retreated -0.10% in June but rose +0.35% over the quarter to finish at 4.31%. For investors, this translated to gains for US Treasuries, with the Bloomberg US Treasury Total Return Unhedged USD Index rising +1.0% in June and +0.1% over the quarter. For Australian government bond returns, the Bloomberg AusBond Treasury 0+ Yr Index rose +0.7% in June, but a larger lift in yields resulted in a negative return of -1.0% for the quarter.

Credit markets (corporate bonds) delivered mostly positive returns. Investment-grade credit performed well both globally and domestically thanks to the relatively higher income earned as credit spreads (the extra compensation a corporate bond must pay above the so-called risk-free rate offered on a government bond with a similar maturity date) widened. Australian credit benchmark Bloomberg AusBond Credit 0+ Yr Index rose +0.4% in June and +0.2% over the quarter, while global credit — as measured by the Bloomberg Global Aggregate Credit Total Return Index Hedged AUD — rose +0.6% in June but was marginally lower over the quarter at -0.1%. The relatively stable economic environment supported riskier parts of fixed interest markets, including global high yield credit, which enjoyed another strong month and quarter — the Bloomberg Global High Yield Total Return Index Hedged AUD was +0.7% and +0.9% higher.

What fund Managers are saying…

“The macroeconomic backdrop is becoming increasingly favourable for G10 bond markets after a difficult start to the year. Hot US inflation prints in the first quarter raised doubts about the Federal Reserve’s (Fed’s) ability to cut rates in 2024. However, more recent data show a resumption of the disinflationary trend. Meanwhile, US growth has slowed to a trend-like rate, and further weakness may be in store as the economy adjusts to high interest rates and reduced fiscal support. Overall, we expect slower nominal gross domestic product (GDP) growth across G10 economies. In turn, this slowdown will enable central banks to lower policy rates from restrictive levels, supporting bond market returns. However, while it feels as if the macroeconomic ship is now sailing smoothly toward something resembling normal, it is important to remember that this is all still uncharted waters. And farther out, the economy is headed toward perhaps even greater uncertainties. One uncertainty is the lack of any historical precedent for the current economic cycle and ongoing post-pandemic rebalancing. But another complicating factor for investors is the upcoming US election, which has the potential to generate significant volatility across a wide range of asset markets.”

Franklin Templeton

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.