Economic Update April 2024

The highlights:

March provided further evidence of the United States (US) economy's enduring strength. Although the slowdown in inflation has decelerated, the trajectory points towards a gradual reduction. This sustained, albeit slow, progress bolstered market confidence that rate cuts from the US Federal Reserve (Fed) are coming.

The encouraging economic news was embraced rather than feared by markets, with shares and bonds wrapping up the first quarter of 2024 positively.

International shares notched their fifth straight monthly gain in March, sending many global indices to new record levels. A positive lead from offshore markets resulted in another strong month for Australian shares, which also hit a fresh all-time high.

With central banks edging closer to a rate-cutting cycle, government bond yields fell in March, helping Australian and international fixed-interest (bond) markets post modest gains.

Market observations

The global economy is surpassing expectations, suggesting a soft landing scenario — where inflation moderates without triggering a recession — is increasingly probable. This positive outlook has prompted upgrades in Gross Domestic Product (GDP) forecasts and company earnings.

Central banks worldwide remain on hold but are indicating a readiness to lower rates, particularly in the US, with a likely timeline set for the middle of the year, and by year's end in Australia. The ongoing debate about the timing and pace of these anticipated rate cuts is expected to influence investor sentiment and market volatility in the near term. Nevertheless, the anticipated direction of rate adjustments is clear, providing likely support for investment markets going forward.

This favourable economic landscape, coupled with the Fed’s signals towards imminent rate reductions, should generally bolster share markets. However, this backdrop has driven valuations in specific market segments to significantly stretched levels. A prime example has been the US mega-cap technology sector, where optimism about the transformative effects of the artificial intelligence revolution on future earnings has driven prices higher.

In light of recent developments, we are adjusting our perspective and portfolio strategy towards a stronger global economy with a diminished risk of recession, while also recognising the prevalence of overvalued markets. The picture in Australia is less clear due to weaker consumer spending and greater interest rate pressures felt by households, prompting a more cautious stance on growth domestically.

Within portfolios, we are looking to trim positions initially acquired as protection against a potential global recession. Instead, we are reallocating into areas offering fairer valuations, like global small companies and high-quality Australian credit, to better align with the current economic environment and market conditions.

Economic Review

Australia

The Reserve Bank of Australia (RBA) was reluctant to discuss potential rate movements at its March meeting, leading markets to push out estimates for the first rate cut from September into the last quarter of 2024. Maintaining the cash rate at 4.35%, the RBA stated that although the rate of inflation had eased in recent months due to moderating prices of goods, service inflation remained stubborn.

In positive news for Australians feeling the pinch of higher living costs, February’s Consumer Price Index (CPI) report showed a continuing downward trend. Headline CPI remained flat year-on-year at 3.4%, while core inflation fell from 4.1% to 3.9%. Despite the moderating inflation and a slowing economy, Australia’s unemployment rate unexpectedly dropped to 3.7% in February as the local economy added 116,000 jobs. Overall, there are signs of an orderly cooling of demand in the economy, supporting the RBA’s wait-and-see approach to monetary policy.

US

A robust economy and a strong labour market drove February inflation results higher. Year-on-year headline CPI rose from 3.1% in January to 3.2% in February, driven largely by gains in the services sector. Core CPI also ticked higher to 3.8% year-on-year. One positive from the result was that core services inflation — which has proven sticky — eased on a month-to-month basis. This area of inflation is a key target for the Fed as it contains the shelter component responsible for a third of the overall CPI calculation.

At its March meeting, the Fed kept rates on hold in a range between 5.25% and 5.5%. Along with the rate decision, the central bank stuck with its earlier forecast for three 0.25% rate cuts by the end of 2024. Fed Chair Jerome Powell would not elaborate on the timing of the cuts but said he was confident they would come as long as the data cooperated. Following the meeting, futures markets were pricing in a nearly 75% probability of a first cut at the Fed’s June meeting.

Europe

Headline inflation in the Euro area was expected to drop from 2.6% in February to 2.4% in March, according to a flash estimate reading from Eurostat. With further evidence inflation is on the path to its 2% target, the European Central Bank (ECB) is tipped to pause one last time at its April meeting before cutting rates in June. There were signs of improving business activity in the region. The Purchasing Managers’ Index — which tracks business activity — rose from 49.2 in February to 50.3 in March, beating expectations. The service sector did most of the heavy lifting, offsetting a deepening downturn in manufacturing.

Asia

In March, the Bank of Japan (BoJ) lifted rates into positive territory for the first time in 17 years when it increased its rate range from -0.1% to between 0.0% to 0.1%. Revised data confirmed the Japanese economy narrowly avoided recession — popularly defined as two consecutive quarters of negative growth — in the last quarter of 2023. China’s economy ended the first quarter on a positive note, with February data on retail sales and industrial production beating expectations. There were also some green shoots in the country’s troubled property sector, with commercial sales and construction improving.

Asset Class Review

Australian Shares

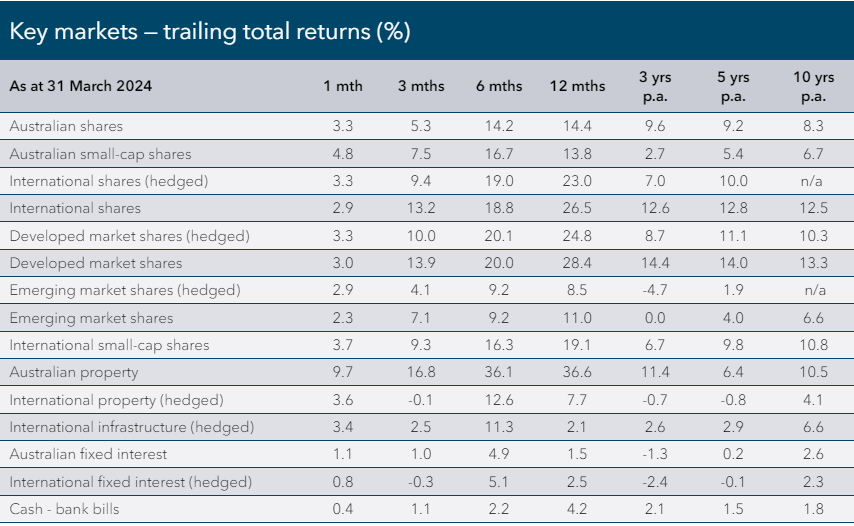

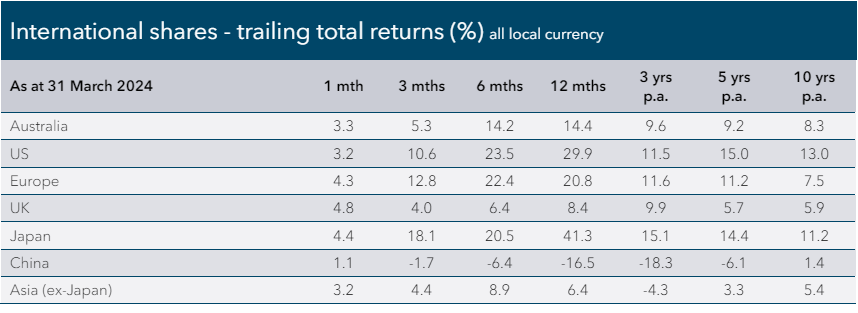

A positive lead from global markets and growing expectations that the RBA’s next move for interest rates will be down helped boost sentiment, resulting in another strong month for Australian shares. The broader S&P/ASX 200 Index rose +3.3% in March and +5.3% over the March quarter, hitting a fresh all-time high. Although the local market performed solidly in an absolute sense, it has lagged behind its global peers by some margin over the past quarter and 12-month periods — largely due to the relatively small size of Australia’s technology sector and its disproportionately large weighting to the underperforming resources sector. Small companies' recent dominance over larger companies continued, with the S&P/ASX Small Ordinaries Index rising +4.8% and +7.5%.

All sectors except for communication services (-0.6%) recorded positive returns in March. Real estate (+9.3%) led the way on the back of firming expectations of rate cuts later in 2024 and outperformance by several sector heavyweights. Energy (+5.3%) was the next best performer, with oil prices closing out the month higher on the prospect of OPEC+ staying the course on production cuts. Other sectors recording strong outperformance in March included utilities (+4.8%) and materials (+3.7%). Over the quarter, information technology (+24.4%) was the clear winner, benefiting from the momentum created in the US technology space. Easing concerns about the economy was a positive for financials (+12.0%), real estate (+15.3%) and consumer discretionary (+12.9%) over the three months. Conversely, materials (-6.2%) were weaker as a -27% fall in iron ore prices dragged the large miners lower.

What fund managers are saying…

After digesting the latest information from (Australian) reporting season results and company meetings, the consensus view is still that of a ‘Goldilocks’ soft landing. However, our analysis of the data and management commentary is that there is more pain ahead…... The deteriorating state of the consumer, atlining retail sales and falling company cashflows are the biggest risks to the downside. The environment plays towards Australian stocks with defensive earnings, robust cash flows, strong balance sheets and cost control amid the ongoing contraction in household budgets. This environment can be navigated, however, it is as important as ever for investors to be focussing on the companies that have pricing power, resilient volumes, and capacity to manage margins while avoiding stocks with valuation risk.“

Martin Currie

International Shares

The late 2023 surge in international share markets continued into the first quarter of 2024. Solid economic data, along with signs inflation is trending towards target levels, provided further support for investor confidence. Shares across all major markets moved higher in March and over the quarter. The MSCI All Country World Hedged Index rallied +3.3% in March — another all-time high — and +9.4% over the quarter. Returns from unhedged shares were slightly lower at +2.9% in March but were +13.2% stronger over the past three months as the Australian dollar dropped from US$0.68 to US$0.65. Global small companies kept pace with their larger peers over the month and quarter, with the MSCI World ex Australia Small Cap Net Return AUD Index advancing +3.7% and +9.3%, respectively.

All sectors were positive over the month and quarter. Energy (+9.2%) was a bright spark as oil prices rose, while materials (+6.7%), utilities (+5.9%) and financials (+5.2%) also enjoyed a strong March. Unsurprisingly, growth sectors, such as communication services (+13.7%) and information technology (+12.8%), dominated the quarter amid the ongoing enthusiasm around artificial intelligence and anything technology-related. US shares hit fresh highs, with the S&P 500 Index and Nasdaq Composite up +3.2% and +1.8% in March. A delayed start and likely slower pace of rate cuts by the Fed than had been expected at the beginning of the year did little to dampen investor sentiment over the quarter. Good company earnings, particularly from some of the Magnicent 7 companies, helped drive the S&P 500 Index up +10.6% over the quarter.

European shares posted strong gains. The Euro Stoxx 50 Index — representing the performance of 50 of the region’s most influential companies — rose +4.3% in March and an impressive +12.8% over the quarter. The United Kingdom’s (UK) FTSE 100 Index advanced +4.8% over the month, lifting the market into positive territory in 2024 despite the UK economy entering a technical recession in the second half of 2023. The rally in Japanese shares continued as the Topix Total Return Index lifted another +4.4% in March and an exceptional +18.1% over the quarter, driven by increasing optimism over the country’s economy and its growing attractiveness to international investors. The MSCI Emerging Markets Index (Hedged) tracked developed markets over the month, increasing +2.9%, but underperformed over the quarter, lifting only +4.0% because Chinese shares fell -1.7% over the same period.

What fund managers are saying…

“When it comes to India, it's all about growth. India is the fastest-growing emerging market and one of the youngest emerging markets. The median age is 28-29. India adds 10-12 million people to the working age every year. We all understand that human capital development in India is great. So it's all about whether we can have high conviction on that long-term growth, which is 6-7%. And I think what has happened in the last two to three years is that the current government has put in the building blocks for us to have a higher conviction on that growth. There has been increased investment in infrastructure, there has been increased investment in manufacturing. They're sitting at a good point in geopolitical tensions as well because the West needs India more to counterbalance what they see in Asia.So I think if you put all that together, that optimism adds to your increased visibility and conviction on long-term growth. And I think that's what driving Indian markets in the current environment.”

Fidelity International

Property and Infrastructure

The highly concentrated Australian real estate investment trust (A-REIT) sector has been on a tear over the past six months thanks to a more favourable interest rate outlook and the oversized contributions of index heavyweights — namely Goodman Group and Scentre Group. Over that time, the S&P/ASX 200 A-REIT Index has advanced a staggering +36.1%, which included gains of +9.7% and +16.8% over the past month and quarter. The ‘everything rally’ spilled over into international property and infrastructure in March, which managed to stay with the broader share market. However, the interest rate-sensitive sectors, which have endured a rough couple of years as rates were lifted, could not keep pace over the quarter as investors chased higher growth sectors. Global property benchmark FTSE EPRA Nareit Developed Index (Hedged) moved +3.6% higher in March but nished the quarter marginally lower, down -0.1%. Global listed infrastructure advanced — the FTSE Global Core Infrastructure 50/50 (Hedged) Index rose +3.4% and +2.5% over the month and quarter.

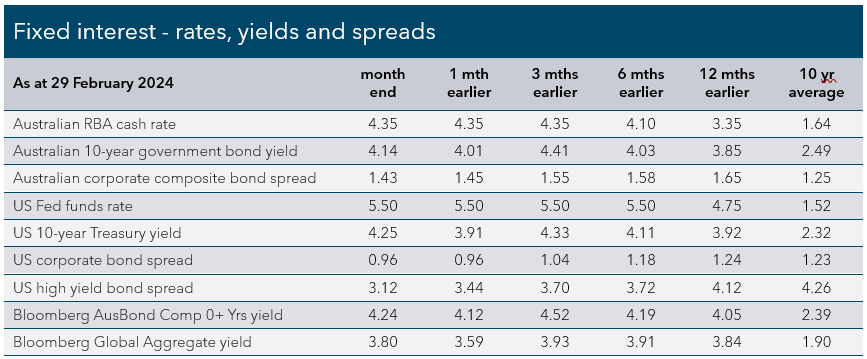

Fixed Interest

Fixed interest (bond) markets posted solid gains in March, with government bond yields moving lower as central banks inched closer to a rate-cutting cycle. The Bloomberg Global Aggregate Bond Hedged Index rose +0.8%, while the local Bloomberg AusBond Composite 0+ Yr Index advanced +1.0%. Returns were more or less flat over the quarter. Global bonds retreated -0.3% as government bond yields moved higher on scaled-back US rate cut expectations and underperformed Australian bonds, which edged +1.0% higher thanks to more stable yields.

The 10-year Australian Government Bond yield fell 0.18% to 3.96% over the month and was unchanged over the quarter. The 10-year US Treasury yield ended marginally lower at 4.20% in March but was 0.32% higher in the quarter. More sensitive to central bank rate settings, two-year US Treasury yields rose even more meaningfully, rising 0.38% to 4.63%, while the Australian equivalent was virtually unmoved. This translated to gains for Australian government bond returns, with the Bloomberg AusBond Treasury 0+ Yr Index up +1.2% and +0.9% over the month and quarter. Returns from US Treasuries were mixed, as the Bloomberg US Treasury Total Return Unhedged USD Index rose +0.6% in March but fell -1.0% over the quarter.

Credit markets (corporate bonds) recorded modest gains. Spreads tightened further, reflecting an improving economic outlook. Returns from Australian credit — as measured by the Bloomberg AusBond Credit 0+ Yr Index — lifted +0.90% in March and +1.37% over the quarter, while global credit — as measured by the Bloomberg Global Aggregate Credit Total Return Index Hedged AUD — was +1.12% higher over the month and -0.28% lower over the quarter. Global high yield credit once again beneted from positive US economic data, which propelled the Bloomberg Global High Yield Total Return Index Hedged AUD +1.5% and +2.3% higher.

What fund Managers are saying…

“Bond markets began 2024 with certainty that a return to 2% inflation would allow the US Federal Reserve (“Fed”) to cut interest rates in March and at every Federal Open Market Committee (“FOMC”) meeting that followed. But what bond markets knew for sure turned out not to be so — leading to disappointment in the form of negative 1.50% returns to start the year. Now, market pricing is more closely aligned with the Fed’s rate cut projections for 2024, creating a better entry point for duration. And fading recession and default fears have improved the outlook for credit. But what the Fed (and markets) know for sure — that policy is restrictive — remains uncertain and a risk to the outlook for bonds. Dynamics such as easing financial conditions from higher asset prices could continue to challenge the level of policy restrictiveness and undermine expected rate cuts.”

BlackRock

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.