Economic Update March 2024

The highlights:

Stronger-than-expected January US inflation data served as a reminder the potential for inflation flare-ups remains. This reinforced the likelihood the United States (US) Federal Reserve (Fed) would delay its first rate cut until later in the year.

International shares extended their winning streak, shrugging off the inflation data as investors redirected their focus to economic growth rather than the timing and pace of Fed rate cuts. The unrelenting hype around artificial intelligence (AI) continued after Magnificent 7 ‘poster child’ Nvidia announced December quarter earnings that smashed sky-high expectations.

A mixed company reporting season, combined with an underrepresented technology sector and commodity price weakness, weighed on the Australian share market relative to its global peers.

In contrast to shares, fixed interest (bond) markets posted weaker returns as bond yields pushed higher (and prices moved lower) as investors unwound expectations for early and rapid rate cuts.

Market observations

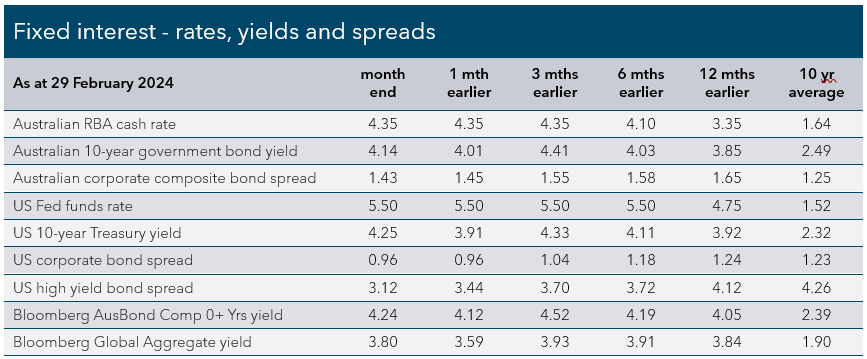

February marked the continuation of bond yield volatility, driven by a significant recalibration in US rate expectations. Investors and the Fed now largely agree on the anticipated path of rates, forecasting three cuts (as opposed to six) in the year and projecting cash rates to fall within the 3.5-4.0% range by the end of 2025. Consequently, bond returns were mildly negative due to this repricing. In Australia, the rate outlook has been more stable, with expectations of a cash rate near 4.0% by year-end.

However, it is important to be aware that despite this consensus, the path ahead remains uncertain and susceptible to fluctuations, particularly as new data on inflation and labour markets emerge, potentially leading to further adjustments in these expectations.

Despite the recent re-evaluation suggesting US rate cuts might occur later than previously anticipated — a development that could be seen as a negative signal for markets — the overall trajectory remains positive. Share markets have demonstrated resilience, choosing to focus on a robust US reporting season over shifting rate expectations.

The recent performance landscape for investment markets has also revealed some sector-specific trends. The strong upswing in shares has not been limited to large-caps, with small-caps keeping pace. This broadening out of the rally is encouraging and supports a dynamic allocation to global small-caps.

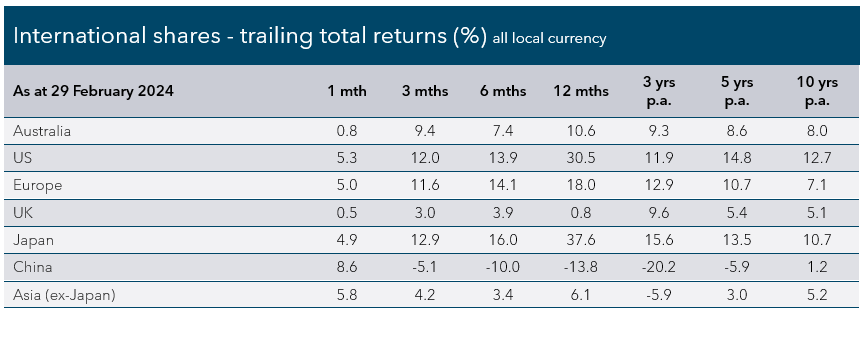

Emerging markets have performed reasonably well despite the economic challenges in China and implications for the wider region. Perhaps counterintuitively, recent returns have been driven by the notable gains in Taiwanese and South Korean markets. This reinforces the view that even in the face of concerning macroeconomic trends, strong fundamentals — characterised by low valuations, improving earnings, and supportive policies — can pave the way for market outperformance.

The unfolding landscape suggests a complex interplay of factors influencing market movements, highlighting the importance for investors to remain adaptable, well-informed, and strategic in navigating these volatile yet opportunistic times.

Economic Review

Australia

After opting to leave the cash rate steady at 4.35% at its early-February meeting, the Reserve Bank of Australia (RBA) is not expected to make any change in its next meeting in mid-March. While the RBA has not ruled out the potential for further rate hikes, the market expects two rate cuts in 2024, with the first move in September.

The January Consumer Price Index (CPI) report showed inflation continued to moderate. Headline CPI fell 0.3% from the previous month and was flat year-on-year at 3.4% — a touch under expectations. Core CPI slowed from 4.2% to 4.1%, representing another step in the right direction and solidifying expectations the RBA is done with its rate-hiking cycle. Wages growth rose 0.9% for the December 2023 quarter and 4.2% over the year — in line with expectations. Labour market tightness remains critical as it determines wage growth, the main driver of the sticky service component of inflation.

US

CPI numbers released mid-February surprised to the upside, with headline CPI up 0.3% in January and 3.1% year-on-year, while core CPI rose 3.9% year-on-year. Published a few weeks later, Personal Consumption Expenditure (PCE) inflation — the Fed’s preferred inflation measure — came in line with expectations, with headline inflation increasing 0.3% over the month and 2.4% year-on-year, while core PCE rose 2.8% from a year ago.

Both inflation reports provided the same overall message. Inflation is making progress toward the 2% target, but January was a step backward and only points to the Fed waiting longer before cutting rates. Despite starting the year with an assumption of seven 0.25% rate cuts, the market is now pricing in less than four in 2024. The Fed meets again on 20 March.

Europe

Estimated (flash) inflation data for February showed headline inflation in Europe eased to 2.6% from 2.8%, and core inflation came in at 3.1%. Both measures were higher-than-expected. There were also some timid signs of improving economic activity, with the manufacturing and services Purchasing Managers’ Index (PMI) rising, albeit still in contraction territory. The European Central Bank (ECB) continued to downplay the chances of an imminent rate cut, saying it does not want to run the risk of reversing any cuts. As expected, the ECB held its main rate at 4.5% at its early March meeting.

Asia

Despite weaker-than-expected December quarter Gross Domestic Product (GDP) data showing the Japanese economy had fallen into a technical recession — it is worth noting Japan’s economy often contracts due to its extremely low growth profile — markets are pricing in a rate rise from the Bank of Japan (BOJ) at its April meeting. This would mark the end of eight years of negative interest rates.

Asset Class Review

Australian Shares

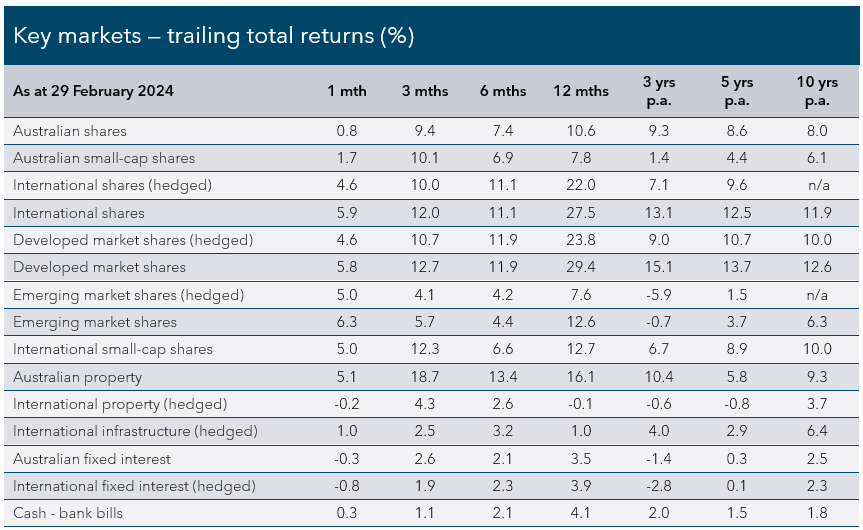

February saw a continuation of the rally on international share markets that began at the end of last year, but domestically, the picture was more muted. A mixed company reporting season, combined with an underrepresented technology sector and commodity price weakness, weighed on the local market relative to its global peers. The broader S&P/ASX 200 Index advanced +0.8% but trailed small companies, which rose +1.7% over the month. Performance was wide-ranging at a sector level.

Information technology (+19.5%) was the clear winner, as the local sector fed off positive US sentiment and optimism around artificial intelligence (AI) hit fever pitch. Consumer discretionary (+9.1%) performed strongly, benefiting from a number of retailers reporting better-than-feared half-year results. The largest falls were in energy (-5.9%) and materials (-5.0%), as company-specific earnings disappointed. Overall, half-year results from Australian companies were mixed, with higher wage costs and falling commodity prices offsetting some positive surprises in sales and margins. 40% of companies beat consensus estimates, while 32% missed — largely in line with long-term averages — but volatility was high, with 15% moving by +/-10% on result day.

What fund managers are saying…

“Overall, Australian company earnings came in better than expected with beats outweighing misses by three to two. Resilient consumer spending, cost management, inflation moderation and positive economic outlooks typified many companies' results. For instance, Wesfarmers — which operates Kmart, Officeworks and Bunnings — beat earnings expectations. But CEO Rob Scott noted that ‘customers are becoming more value-conscious’ and that ‘cost control helped mitigate the cost of doing business pressures from inflation’.

Consumer discretionary, real estate and information technology sectors were the standout sectors over the past month, while communication services and health care reported the most misses against analyst expectations.

While Australian companies fared better than expected, we think the market is a touch too optimistic on Australia’s economic outlook. Inflationary pressures are more pronounced locally than globally, requiring the RBA to keep rates on hold for longer. Companies also noted an acceleration in labour costs, driving the implementation of cost management initiatives to protect margins. For our part, we believe there won’t be any rate cuts until Q4.”

VanEck

International Shares

International share markets achieved their fourth straight monthly gain in February, shrugging off recent data suggesting the pace at which inflation is declining had slowed. Investors now appear more focused on economic growth than on the timing and pace of Fed rate cuts. Shares across all major markets advanced on optimism about the US economic outlook and a solid company reporting season. The MSCI All Country World Hedged Index rallied +4.6% to reach a new all-time high, while the unhedged shares jumped +5.9% as the US dollar strengthened.

In recent months, the rally has broadened, with an increasing number of companies participating in the upswing. This has benefited global small companies, which kept pace with their larger peers in February — the MSCI World ex Australia Small Cap Net Return AUD Index advanced +5.0%. Sector performance was broadly positive. The unrelenting rally in big tech powered gains for the consumer discretionary (+8.0%) and information technology (+6.3%) sectors. Defensive sectors, including consumer staples (+0.9%) and utilities (-0.8%), brought up the rear as investors flocked to growth sectors. In terms of equity style, growth (+6.4%) and quality (+6.1%) again outperformed value (+2.8%) over the month.

US shares hit fresh records, with the Magnificent 7 group of mega-cap technology companies, led by ‘poster child’ Nvidia, pushing the S&P 500 Index and Nasdaq Composite up +5.3% and +6.2%, respectively. The Magnificent 7 has accounted for around half of the S&P 500 Index’s gains so far in 2024 and now collectively represents a quarter of the value of the US share market. In the now completed December quarter US reporting season, nearly three-quarters of companies reported positive earnings surprises, demonstrating the resilience of the US economy.

European shares also advanced. The Euro Stoxx 50 Index rose +5.0%, thanks to the dominant performance of the so-called ‘Granolas’ — Europe’s answer to the US’s Magnificent 7 — which have been a large part of the reason European shares have performed well despite a weak economy. The Granolas include GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH Moët Hennessy Louis Vuitton, AstraZeneca, SAP, and Sanofi. The United Kingdom’s (UK) FTSE 100 Index lifted +0.5% and was the worst-performing of the major markets, as data confirmed the UK fell into a technical recession in the second half of 2023.

The rally in Japanese shares continued in February as the Topix Total Return Index jumped +4.9%, shrugging off the somewhat common reoccurrence of another technical recession. The alternative Nikkei 225 Index, which provides a more widely known but less appropriate representation of the Japanese share market, exceeded its all-time high recorded all the way back in 1989. The MSCI Emerging Markets Index (Hedged) jumped +5.0%, thanks to a strong Chinese market, which rose +8.6% in February as investors looked to the upcoming National People’s Congress for any hints at the government’s willingness to support the economy with stimulus initiatives.

What fund managers are saying…

“High-profile endorsements of Japanese blue chips ignited optimism in Tokyo’s markets last year as the yen depreciated. An expected macro regime shift from deflation to inflation, robust corporate earnings and Japan’s corporate governance reform efforts, such as improved shareholder advocacy, are fueling further optimism in 2024.

The bullishness comes despite Japan’s fall in world rankings — when Germany eclipsed it recently as the world’s third-largest economy — following a surprise technical recession in the third quarter of 2023. Prospects for wage growth also continue to underpin the country’s still-sluggish private consumption and capital spending. Fortunately, however, economists anticipate Japan’s 2024 wage hikes to be higher than last year’s already encouraging increase of 3.6%—the highest in three decades.

In late-February, the Nikkei 225 also broke its highest level since 1989 (the year Nintendo’s Game Boy was first released), making Japanese stocks some of the best-developed market performers thus far this year. Market exuberance over artificial intelligence (AI) is at a ‘tipping point’, and the sharp depreciation of the Japanese yen has led to even more foreign investors buoying Japan’s stock market.”

Franklin Templeton

Property and Infrastructure

Stronger-than-expected US inflation data and a growing likelihood rate cuts will arrive at a slower pace in 2024 weighed on interest rate-sensitive asset classes like global infrastructure and property. Global listed infrastructure advanced — the FTSE Global Core Infrastructure 50/50 (Hedged) Index rose +1.0% in February — but was outshone by the broader rally in global share markets as investors favoured growth over defensive real asset exposure. Global property — as measured by the FTSE EPRA Nareit Developed Index (Hedged) — retreated -0.2%. Australian property was again an anomaly, performing strongly in February as the S&P/ASX 200 A-REIT Index lifted +5.1% to extend its recent rally.

What fund managers are saying….

“2024 is set to be a pivotal year for the global economy, as we move past peak rates, growth moderates, and inflation continues its downward path to central bank target bands. There is still a potential window open for a recession considering the “long and variable lags” of monetary policy transmission.

For now, however, the market is pricing in a goldilocks scenario where inflation settles and growth doesn’t suffer a hard landing. This last mile of disinflation could be harder to achieve than the market is hoping for, meaning that rate cuts start in the second half of the year. Either way, lower rates are a tailwind for long-duration infrastructure assets, which we forecast to continue to have strong earnings growth driven by multi-decade thematics.”

4D Infrastructure

Fixed Interest

In contrast to shares, fixed interest (bond) markets erased some of their recent gains during February as investors reassessed the trajectory for interest rates in light of stronger-than-expected growth and inflation data. Bond yields moved higher over the month as investors tempered expectations about the pace of rate cuts by the Fed. Global bonds retreated as the Bloomberg Global Aggregate Bond Hedged Index slipped -0.8%. In Australia, where rate expectations are more stable, the fixed interest market ended the month marginally behind where it started, with the Bloomberg AusBond Composite 0+ Yr Index -0.3% lower.

Government bond yields rose in February, meaning prices came under pressure. The 10-year Australian Government Bond yield ticked up to 4.14%, while the 10-year US Treasury yield moved more meaningfully to 4.25% on the back of the surprisingly higher January CPI print. The two-year US Treasury yield — more sensitive to monetary policy (rate setting) — ended February considerably higher at 4.64%, while in Australia, the two-year yield was unmoved. This resulted in a negative month for government bond returns, with the Bloomberg US Treasury Total Return Unhedged USD Index down -1.3% and the Bloomberg AusBond Treasury 0+ Yr Index off -0.4%.

Credit markets (corporate bonds) were mixed. Investment-grade credit spreads remained tight, but rising yields impacted returns. Australian investment-grade credit — as measured by the Bloomberg AusBond Credit 0+ Yr Index — edged up +0.1% in February, while global investment-grade credit retreated, with the Bloomberg Global Aggregate Credit Total Return Index Hedged AUD -1.2% lower. Global high yield credit was once again the standout performer, benefiting from a positive economic outlook which pushed the Bloomberg Global High Yield Total Return Index Hedged AUD +0.5% higher.

What fund Managers are saying…

“Our view has been that the inflation rate would recede to Fed target levels without the necessity of inducing a recession. We continue to maintain that the path and timing of Fed rate cuts will depend primarily on the strength of the US economy, as the Fed is desirous to wait as long as possible. Recent economic resiliency has caused market reassessment of the timing of rate cuts. But the more important point, is that short rates of 5% or more are simply too high. Fortunately, the economy has been able to hold up, but we strongly suspect that restrictive rates, tighter credit conditions and, most importantly, a retrenchment from elevated consumer spending will bring a moderation in US growth. This will set the stage for the Fed to cut rates. The bond market may or may not wait for that eventuality. The current elevated level of interest rates suggests that investors should be willing to capture today’s longer-term Treasury yields. This is the reason the Treasury yield curve continues its multi-year period of being inverted.”

Western Asset

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.