Economic Update February 2024

The highlights:

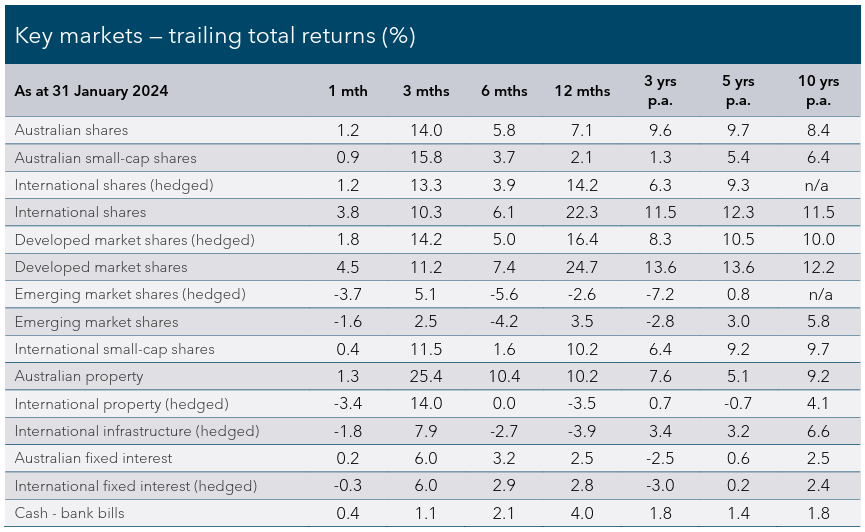

After a grandstand finish to 2023, markets got off to a more subdued start in the new year with sentiment wavering as investors contemplated the prospect of a delayed monetary policy pivot towards rate cuts, in an environment of robust growth and elevated inflation.

At its late-January meeting, the United States (US) Federal Reserve (Fed) Chair, Jerome Powell, shot down the possibility of a rate cut in March and insisted the Fed will move carefully on rate cuts, with probably fewer than the market expects.

Share markets, for the most part, shrugged off doubts about the speed of central bank rate cuts, to extend their gains in January. The Magnificent 7 again powered US shares to new highs, while the Australian market also closed out the month at an all-time high.

In contrast to December, fixed interest (bond) returns were broadly flat in January. Despite some volatility in bond yields during the month as rate expectations moved around, both government bond and credit (corporate bond) markets finished the month more or less where they started

Market observations

In January, markets received a reality check on how soon, and how many, rate cuts the Fed might deliver this year. Six rate cuts — with the first due in March — is what the market was pricing in at the start of the year. In our view, this seemed a little optimistic. These expectations started to fade over the course of the month and were all but dashed following the strong January US jobs report, which sent bond yields higher.

With some of the stretch coming out of rate cut expectations, cash rate-sensitive sectors have underperformed, and upward pressure on the US dollar has taken the Australian dollar (AUD) down to US$0.65.

This hasn’t changed our strategy. We remain invested, believing a neutral exposure to growth assets is appropriate in the current environment. Although we are optimistic an economic soft landing can be achieved and will be supportive for markets, we remain cautious on stretched valuations and optimistic assumptions around earnings growth, rate cuts, and infation normalisation.

Economic Review

Australia

December employment data pointed to a weakening labour market. 65,000 jobs were lost, but a fall in the participation rate — the number of people in work or looking for work — offset these losses, resulting in the unemployment rate remaining unchanged at 3.9%. Leading indicators, such as job adverts and vacancies, also point to further moderation in the labour market.

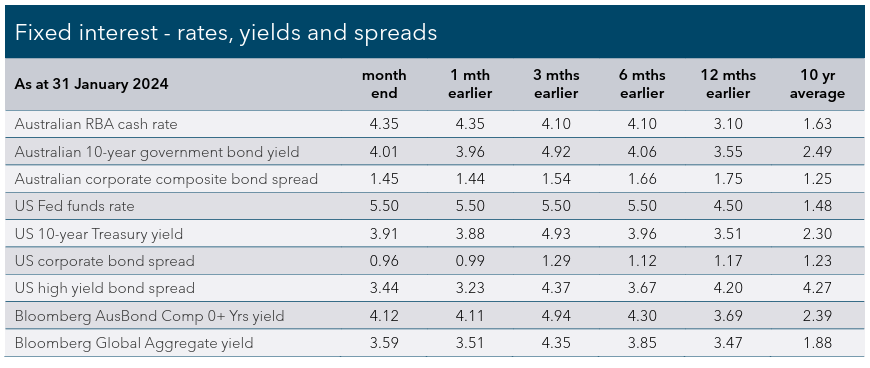

The December Consumer Price Index (CPI) report confirmed headline inflation of 4.1%. This was lower than the Reserve Bank of Australia (RBA) expected at year-end, raising hopes it is done with hiking rates. The RBA opted to leave the cash rate steady at 4.35% at its early-February meeting. RBA Governor, Michele Bullock, would not be drawn on whether rate cuts were on the horizon, even refusing to rule out more rate hikes while inflation remained stubbornly high.

US

CPI inflation was higher than expected in December, showing headline inflation in the US had ticked up to 3.4%. The Fed held its policy-setting meeting at the end of January, where it held rates on hold at 5.25% to 5.50%. Comments from Fed chair Jerome Powell indicated that while rates have peaked, a rate cut at the next meeting in March was unlikely.

Seeking greater confidence inflation is on track to its 2% target, the Fed will have been disappointed with the January employment data released in early February, which showed job growth surged, and wage growth accelerated. The closely watched jobs report showed 353,000 jobs were added in January, double expectations, while the unemployment rate remained unchanged at 3.7%. Signs of persistent strength in the labour market and stubborn inflation could make it difficult for the Fed to start cutting rates in May, as markets are currently pricing in.

Europe

Hopes of an early rate cut from the European Central Bank (ECB) began to fade after headline inflation data jumped from 2.4% in November to 2.9% year-on-year in December. However, this was followed by the release of estimated (flash) inflation data for January, which confirmed headline inflation is likely to ease to 2.8%. The ECB kept rates on hold at its late January meeting and pushed back on rate cut expectations, reiterating the key rate would stay at 4.5% for some time.

Asia

The Chinese economy continues to fight deflation, with CPI inflation data confirming prices fell -5.9% year-on year in January. There was a further deterioration in the country’s property crisis with the announcement heavily-indebted property behemoth, Evergrande, had gone into liquidation. Chinese authorities have announced a number of stimulus measures, but none have been what markets were hoping for to re-ignite growth. This included a muted response to pumping one trillion yuan of liquidity into the market by cutting the Reserve Requirement Ratio — which determines the amount of cash banks must keep in reserve.

Asset Class Review

Australian Shares

An impressive last-quarter run for Australian shares carried over into 2024. The S&P/ASX 200 Index rose +1.2% in January to close at a record high, with investors encouraged by recent CPI data confirming a positive deceleration in inflation, which has all but removed the risk of further RBA rate hikes. Small companies also rose, with the S&P/ASX Small Ordinaries Index gaining +0.9%. Most sectors had a positive start to the new year. Energy (+5.2%) rode the oil price higher, with positive economic growth data boosting demand expectations, while Middle East supply concerns added support. Financials (+5.0%) enjoyed another strong month as banks benefited from a resilient property market and demand for mortgages. The recent recovery in several of Australia’s largest healthcare names continued, lifting the sector higher (+4.3%), while materials (-4.8%) was dragged lower by a weaker-than-expected second-quarter update from index heavyweight BHP, and the retracement of a strong iron ore price. The local half-year company reporting season has just got underway, with aggregate forecasts pointing to modest earnings growth. Several companies have recently been punished for negative trading updates, suggesting some ongoing caution is warranted toward companies with high valuations and optimistic growth expectations.

What fund managers are saying…

“As the world continues to normalise to peak rates and long-term ination expectations, the environment plays towards Australian stocks with defensive earnings, robust cash flows, strong balance sheets and cost control amid the ongoing contraction in household budgets. Right now, it is more important than ever for investors to be discerning in their stock picking, focussing on the right companies in this environment, avoiding stocks with valuation risk, or issues with poor pricing power, falling volumes, rising costs or sustainability concerns.

Within the attractively valued Australian market, we continue to see a wide dispersion between growth and value style stocks. This valuation dispersion narrowed in 2021-2022 on higher rates, but since the peak rate narrative and excitement around AI kicked off in March 2023, the valuation dispersion has again widened. Our view is that the greater the valuation dispersion between typical value stocks and growth stocks, the greater the excess return opportunity for a disciplined valuation investment approach.”

Martin Currie

International Shares

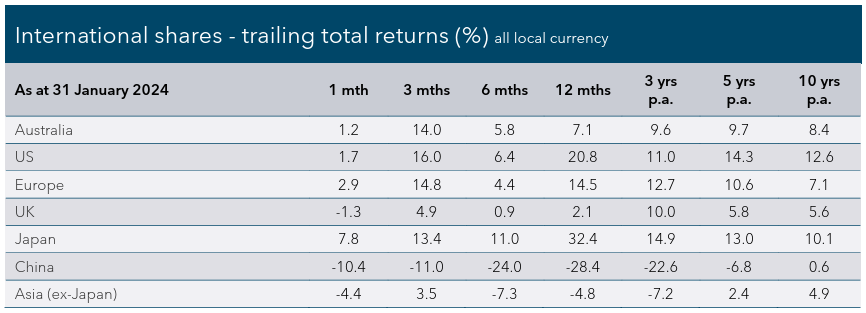

Share markets mostly looked past recent doubts about the speed of central bank easing to extend their gains in January, with the MSCI All Country World Hedged Index rising +1.2% to reach a new all-time high. A devaluation in the Australian dollar against the US dollar was positive for unhedged international shares, with the MSCI All Country World Unhedged Index lifting +3.8%. Small companies — sensitive to interest rates — had a positive month but trailed large companies as markets pared back the magnitude of the expected Fed rate cuts. The MSCI World ex-Australia Small Cap Net Return Index edged up +0.4%. Sector performance was mixed. Materials (-3.6%) and real estate (-3.9%) retreated, while unrelenting gains in the Magnicent 7 drove the outperformance of communication services (+4.6%) and information technology (+4.3%) sectors. This also explained why, in an equity-style context, growth (+2.7%) and quality (+3.3%) signicantly outperformed value (+0.8%) over the month.

Regional performance varied. Gains from the Magnificent 7 propelled the S&P 500 Index +1.7% in January to a record high, and the technology-focused Nasdaq Composite advanced +1.0% to within a touching distance of its record close reached back in 2021. European shares posted an impressive month of returns, with the Euro Stoxx 50 Index jumping +2.9% thanks to a buoyant technology sector. Sectors that had rallied in late-2023 on expectations of rate cuts — including utilities and real estate — were among the weaker performers. The UK’s FTSE 100 Index fell 1.3% as expectations of rate cuts were pushed out, following an unexpected increase in UK inflation. Japanese shares had an excellent start to 2024, with the Topix Total Return Index — the best-performing major market last year — rising +7.8% on growing confidence in a healthier economy and company earnings. The MSCI Emerging Markets Index (Hedged) gave back -3.7% in January, with China (-10.1%) once again the main drag on performance as stimulus measures failed to lift the market against a backdrop of the ongoing property crisis and further US sanctions on Chinese technology companies.

What fund managers are saying…

“Rate cuts are, broadly speaking, good news for investors. No surprise there. Falling rates reduce the cost of borrowing for businesses and households, and they make risk-free assets like cash relatively less attractive. Boosting the stock and bond markets makes people feel richer, so it’s an obvious tool for a central banker trying to stimulate the economy.

Within the stock market, which sectors or styles might you expect to do best in a rate-cutting environment? Shares with lots of future growth potential should do better because a lot of their value is accounted for by cash flows that will materialise many years hence. Lower interest rates increase how much these are worth in today’s money, which is why the Magnicent Seven tech stocks did so well last year, as investors anticipated lower rates, and so badly in 2022, when the cost of borrowing was rising.

However, the reason for the rate cuts is important. That’s because cheaper ‘value’ shares tend to do well in a cyclical economic upswing. In the absence of a recession, a rate-cutting cycle can favour shares whose value is more in the here and now — industrials, property companies, smaller companies. Many of these underperformed in 2023, and they might be expected to play catch up as and when rates start to fall this year.”

Fidelity International

Property and Infrastructure

Having rallied in late 2023 on hopes of imminent rate cuts, the FTSE EPRA Nareit Developed Index (Hedged) fell -3.4% in January as the Fed expressed a need for more evidence inflation was continuing to decline before moving to rate cuts, which weighed on the interest rate-sensitive global property sector. Australian real estate investment trusts (REITs) bucked this trend, with strong fundamentals helping to lift the S&P/ASX 200 A-REIT Index +1.2% and extend an impressive recent rally. After a strong last quarter, global listed infrastructure retreated as expectations of an aggressive cycle of rate cuts was pushed out — the FTSE Global Core Infrastructure 50/50 (Hedged) Index dropped -1.8% over the month.

What fund managers are saying….

“We view the relative underperformance of global listed infrastructure (GLI) securities in 2023 to be predominantly driven by non-fundamental factors, given the favourable top and bottom-line trends for most asset/industry types in infrastructure. Looking at the four broad industry categories of core listed infrastructure securities strategies — utilities, energy infrastructure, communications and transportation — only communications exhibit a challenging 12-24 month fundamental backdrop, largely concentrated within the US wireless tower subsector. In other sectors, we see solid, mid-to-high-single-digit revenue and cash flow/earnings growth, with some subsectors exhibiting even stronger fundamental trends. In the context of a decelerating global economy (in most regions), we certainly view these stable operating trends as quite favourable.

In our view, current share price levels for GLI paint a materially positive view, relative to both the global equity markets and precedent private-market infrastructure transactions, given the lacklustre 2023 performance. GLI now trades at levels below the post-pandemic trough versus. global equities, despite a materially different fundamental picture.”

Morgan Stanley

Fixed Interest

Fixed interest (bond) markets came down from last month’s heights to trade sideways in January. After declining rapidly in the last two months of 2023, bond yields edged marginally higher in January as investors recalibrated their monetary policy expectations in favour of a later pivot to rate cuts than what was the case a month ago. The Bloomberg AusBond Composite 0+ Yr Index edged +0.2% higher, while global bonds were moderately lower, with the Bloomberg Global Aggregate Bond Hedged Index slipping -0.3%.

Government bond yields crept up ever so slightly, with 10-year US Treasury and Australian Government Bond yields ending January at 3.91% and 4.01%, respectively. Similar moves were seen in shorter-dated government bond yields. Two-year US Treasury and Australian Government Bond yields finished at 4.27% and 3.73%. This resulted in a flat month for government bond returns, with the Bloomberg AusBond Treasury 0+ Yr Index up +0.2% and the Bloomberg US Treasury Total Return Unhedged USD Index down -0.3%. Sentiment from shares owed into credit (corporate bond) markets, where credit spreads tightened further, outperforming government bonds. Australian investment-grade credit — as measured by the Bloomberg AusBond Credit 0+ Yr Index — rose +0.4% in January, while global investment-grade credit was marginally lower, with the Bloomberg Global Aggregate Credit Total Return Index Hedged AUD -0.2%.

What fund Managers are saying…

“Our base case is for the RBA to remain on hold at current rates before commencing an easing cycle in September 2024. We price a more modest than average easing cycle, of around 1.75%, spread over 12 months. We see the risks skewed to the downside, with a rising probability that the RBA may have to move earlier and slightly faster than our base case. In this scenario, the RBA starts moving in August 2024, with a total of 2.50% of cuts, to below neutral interest rates. The Fed is anticipated to start easing in May, while the ECB starts easing in April.

We see the very near-term RBA pricing as relatively in-line with expectations. However, the expectation of policy rates held above neutral over a period of years continues to underestimate the cyclical risks. We currently consider the Australian yield curve as under-valued at points in the curve. We hold a long duration position and look to add to it on any worsening of the economic outlook.

In recognition of the softening growth environment, our credit strategy remains skewed towards high-quality, investment grade issuers with resilient business models, solid earnings power and conservative balance sheets. We have been actively and selectively taking advantage of the attractive yields on offer in highly rated corporate bonds and structured credit, particularly in the primary markets where transactions have come with new issue concessions. While we believe that the cumulative impacts of restrictive financial conditions will become evident, we are mindful of a healthy starting point of above full employment and remain open-minded to a wider range of potential economic outcomes including those involving a soft-landing.”

Janus Henderson

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.