Economic Update January 2024

The highlights:

The long-awaited pivot in monetary policy from the United States (US) Federal Reserve (Fed) arrived at its December meeting. Although the Fed kept the federal funds rate target on hold, it flagged the current rate hike cycle was as good as over, with three rate cuts forecast in 2024.

The ‘Santa Claus Rally’ came early for global share markets as bond yields continued to fall on the back of softer inflation data and the Fed’s dovish December meeting commentary. All global markets except for Japan and China advanced in December, while Australia was one of the top-performing markets.

Fixed interest markets were positive across the board in December as markets repriced for a lower inflation and interest rate environment. Government bonds posted strong returns, as did credit (corporate bond) markets.

Despite remaining cautious about the possibility of a ‘hard-landing’, a ‘soft-landing’ — where central banks achieve a normalisation of inflation without triggering a recession — remains our base case scenario for the US economy.

Outlook for Investment Markets

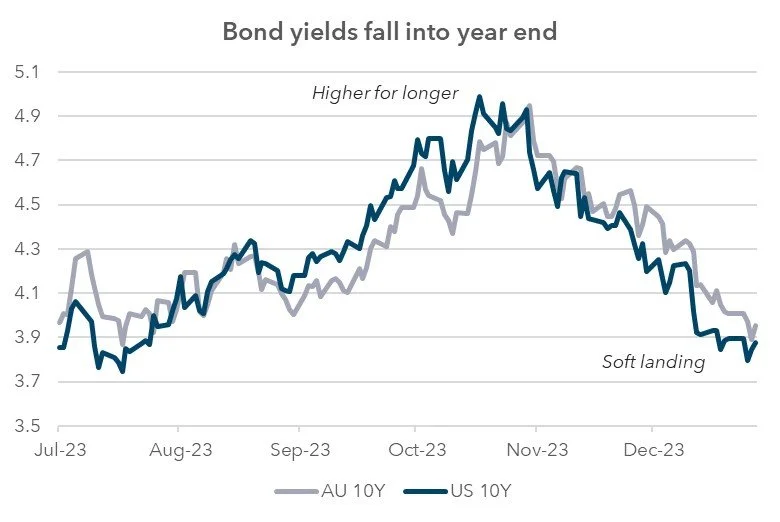

From July through October, bond markets priced in an environment of ‘higher for longer’ inflation and cash rates. US 10-year Treasury yields hit 5.0% briefly and caused investors enough concern to mark down valuations on shares in response.

From the start of November, a sharp trend down in bond yields began. Triggered initially by a positive US inflation data print and extended in December by a surprisingly dovish statement by Fed Chair Jerome Powell, bond yields reverted to levels aligned with a ‘soft landing’ scenario. The year ended with US and Australian 10-year bond yields below 4.0%.

Source: Bloomberg/Evidentia

Share markets have rallied in response. Government bond yields represent the financial relationship between time and the value of money. As yields fell, the assets with a higher proportion of cashflows expected further out into the future outperformed — some of the strongest performers have been infrastructure, property and high-growth companies.

The market remains wedged between a ‘not too hot, not too cold’ growth objective. The bond moves from July to October were the response to investors’ perception of a ‘too hot’ environment, and the corresponding sell-off in share markets reminded us that yields and anticipated central bank policy continue to be the core drivers of share markets. Current yield levels and share market multiples imply we are back in the goldilocks zone of a ‘soft landing’ in which investors are optimistic central banks will achieve a normalisation of inflation without triggering a recession.

A constructive outlook for shares relies on a ‘soft landing’ outcome, and based on our analysis of inflation trends and economic growth forecasts, a ‘soft landing’ remains our base case. However, two broad risks threaten this base case:

lower growth than expected — a ‘hard landing’ scenario; and

higher and sticker inflation than expected — a ‘higher for longer’ scenario.

Our evolving view is that of these two risks, the greater likelihood is a ‘hard landing’. Although recent data indicates inflation and economic activity are slowing, we are yet to see the full impact of the rate-hiking cycle on the economy. These so-called ‘long and variable lags’ in monetary policy have been extended due to pent-up household savings during the pandemic, YOLO (you only live once) consumption attitudes, and fixed rate mortgage structures (now rolling off in Australia).

As we enter 2024, the possibility of a ‘hard landing’ appears to have faded from investors' concerns. Although we are increasingly optimistic that a ‘soft landing’ is within reach, this scenario is already priced into markets, leading to limited upside. There also remains a meaningful possibility the slowdown is larger than desired, which is not priced into markets. Accordingly, we will continue to take opportunities to tilt portfolios toward fairly priced assets that should perform well in both these scenarios — such as bond duration and quality style shares.

Economic Review

Australia

The Reserve Bank of Australia (RBA) ended the year by leaving the cash rate on hold at 4.35% at its December meeting but continues to monitor for inflation risk. The market is pricing a less aggressive rate cut path for the RBA in 2024 compared to other central banks. The odds of one final rate hike in February have fallen, with the market expecting two rate cuts later in 2024. The RBA has forecast core CPI — which excludes volatile price items — to fall into its 2-3% target range by the end of 2025. The monthly Consumer Price Index (CPI) report for November is expected to show a drop in annual headline inflation from 4.9% to around 4.4%.

Gross Domestic Product (GDP) data showed the local economy slowed over the September quarter. Although overall GDP grew by 2.1% year-on-year, this was underpinned by strong population growth. Per capita GDP actually fell by 0.3% year-on-year. 61,500 jobs were added in November, however, a rise in the labour supply or participation rate resulted in a marginal rise in the unemployment rate to 3.9%. Total hours worked were flat, implying average hours worked were lower, and businesses are reducing hours instead of making layoffs.

US

The Fed left its interest rate target unchanged at 5.25% to 5.50% when it met in mid-December, but markets rallied when it signalled a significant shift in its near-term forecasts for rate cuts — three 0.25% rate cuts in 2024. While these cuts would be meaningful, the market is currently pricing in a more optimistic six cuts in 2024 beginning in the first quarter. This scenario would likely require a sharper economic slowdown than the ‘soft-landing’ scenario the Fed appears to be predicting.

September quarter GDP was revised down but still expanded at a strong pace of 4.9% year-on-year. Even with a slowdown forecast for the December quarter, this is a long way away from the recession predictions made at the beginning of 2023. The enduring strength of the labour market and US consumers have been the key drivers. The economy added 199,000 in November, slightly above estimates and ahead of the gain in October, while the unemployment rate fell to 3.7%. A recent surge in consumer sentiment data suggested there is optimism around easing inflation.

There was further good news about inflation, with the Personal Consumption Expenditure Index (PCE) declining by 0.1% in November, its first month-to-month decline since mid-2020. Annual core PCE — which excludes volatile food and energy prices and is closely tracked by the Fed — came in below forecasts at 3.2%, moving closer to the Fed’s goal of 2%.

Europe

Manufacturing Purchasing Managers' Index (PMI) data for December remained firmly below the 50 level, indicating further contraction in the European economy. Having shrunk -0.1% in the September quarter, a contraction in the upcoming December quarter data would meet the definition of a recession. The European Central Bank (ECB) took a more cautious stance than the Fed, repeating the message of no cuts in the first half of 2024. However, this was largely ignored by markets, which are pricing in 1.5% worth of cuts over the coming year.

Headline CPI inflation in the United Kingdom (UK) fell by more than expected to hit 3.9% year-on-year in November — its lowest reading in over two years. Core CPI came in at 5.1%, also well below forecasts. The surprisingly large drop in inflation undermined earlier comments made by the Bank of England (BoE), pushing back against market expectations for significant cuts to rates in 2024. The BoE left the bank rate at 5.25% at its December meeting and warned the UK is facing a 50-50 chance of a recession in 2024.

Asia

The Chinese economy is expected to hit its official growth target of 5% in 2023, before slowing to between 4.5%-4.8% in 2024. Chinese headline CPI inflation fell -0.5% year-on-year in November at its fastest rate in three years, while manufacturing PMI remained in contraction territory in December. Although recent policy meetings have highlighted the need for further fiscal stimulus to prop up growth, major initiatives are yet to be announced.

Asset Class Review

Australian Shares

In Australia, the S&P/ASX 200 Index enjoyed a very strong rally to end the year, jumping 7.3% in December and +8.4% over the quarter. Smaller companies kept pace with their larger peers as the S&P/ASX Small Ordinaries Index gained +7.2% and +8.5% over the month and quarter. The rally was broad-based, with all sectors in positive territory in December. Real estate (+11.5%) and healthcare (+9.1%) backed up strong November performances, while materials (+8.8%), information technology (+7.4%) and communication services (+7.1%) also made impressive gains.

What fund managers are saying…

“Investors are increasingly pricing in peak rates in many economies. While this makes some sense given progress in reducing inflation, the key issue for markets is how long are higher rates needed to slow growth and get inflation close to central bank targets, typically around 2%? We think there is still a good deal of uncertainty over this issue. Labour markets in developed economies, including Australia, still appear too tight for comfort. This may be inconsistent with reaching inflation targets within a reasonable time frame, which will most likely require growth to slow further and unemployment to rise.

Resilience in economic activity and employment in 2023, while supporting equity markets, paradoxically creates the risk of a nastier downturn in 2024, forcing central banks to disappoint market expectations of interest rate cuts. The collateral damage from sustained high interest rates will include corporate earnings and we expect to see further downgrades in 2024. Whether or not we experience a mild recession or soft landing next year, it is highly likely that we will suffer a sharper fall in corporate profits as economies continue to gradually lose momentum.

The markets’ focus has changed from valuation risk to earnings risk. Cracks in consensus earnings expectation have started to appear in various sectors. We expect the more cyclical parts of the Australian share market to come under greater earnings pressure in 2024, which should see quality, defensive and growth companies benefit as their earnings could prove more resilient.”

T. Rowe Price

International Shares

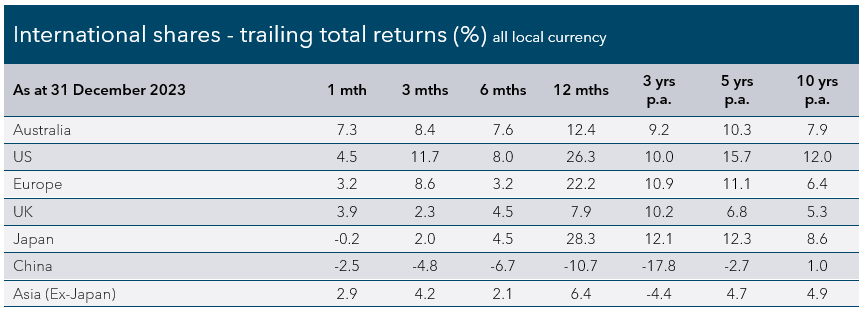

Growing optimism central banks will cut interest rates sooner and harder in 2024 than previously predicted sent bond yields plummeting and delivered impressive returns for international shares in the final quarter of 2023. The MSCI All Country World Hedged Index rose +3.9% in December and +8.7% over the quarter. Further weakness in the US dollar was a drag for unhedged shares, with the MSCI All Country World Unhedged Index rising +1.8% and +5.0%. Small Companies outperformed the broader market in December, with the MSCI World ex-Australia Small Cap Net Return Index up +6.5%. Almost all sectors produced positive returns over the month, with real estate (+8.0%) the standout, and economically sensitive industrials (+6.4%), and materials (+5.4%) also outperforming. The only sector to fall was energy (-0.8%), which rode the oil price lower as OPEC+ was unable to agree on supply cuts.

US shares got to within touching distance of their all-time high late in December. The S&P 500 Index ended the month up +4.5% and was the best-performing major share market over the quarter, delivering +11.7%. This late rally helped push the world’s largest market up +26.3% over the year. Although gains broadened out over the final months of the year, more than two-thirds of the companies on the S&P 500 Index returned less than the index in 2023 as the surge of enthusiasm surrounding artificial intelligence drove a top-heavy rally, including the ‘Magnificent Seven’. Coming off a brutal 2022, the technology-focused Nasdaq Composite Index rallied +43.4% in 2023, lifting +5.5% and +13.6% over the month and quarter.

Also supported by softer inflation data and hopes of interest rate cuts, the final quarter was a strong one for European shares. The Euro Stoxx 50 Index gained +8.6%, including +3.2% in December. A higher exposure to the underperforming energy sector and currency strength weighed on the UK’s FTSE 100 Index, which rose +3.9% in December and +2.3% over the quarter. The Japanese Topix Total Return Index — the best-performing major market in 2023 — didn’t benefit as much as other markets from the dovish central bank tailwind, falling -0.2% in December but edging up +2.0% over the quarter. Despite further weakness in China, emerging markets advanced on the back of strong returns elsewhere, like in Latin America, which has benefited from a weaker US dollar. The MSCI Emerging Markets Index (Hedged) added +2.9% in December and +5.0% over the quarter.

What fund managers are saying…

“A strong corporate earnings rebound could be the tailwind that drives stock prices in 2024. Heading into the new year, the economy continues to send mixed signals. But when it comes to stock prices, one of the metrics that matters most is corporate earnings.

In the US, Wall Street analysts expect earnings for companies in the S&P 500 Index to rise nearly 12% in 2024, based on consensus data compiled by FactSet. That’s along with an expected 6.1% earnings boost in developed ex-US markets and a robust 18% gain in emerging markets.

Given the difficulties of 2023, it’s logical to expect an earnings rebound in 2024. However, there are several risks that could result in substantial earnings revisions, including sluggish consumer spending, slowing economic growth in Europe and China, and rising geopolitical risk from the wars in Ukraine and Israel.”

Capital Group

Property and Infrastructure

The interest rate-sensitive property sector, which had struggled in the face of higher interest rates for much of 2023, continued its late surge as markets priced in additional rate cuts in 2024. Locally, the S&P/ASX 200 A-REIT Index was the top-performing sector, soaring +11.5% in December and +16.6% over the quarter, well in front of the broader S&P/ASX 200 Index. Global property also rallied, with the FTSE EPRA Nareit Developed Index (Hedged) jumping +8.2% and +12.7% over the month and quarter. After outperformance in 2022, 2023 was an uncharacteristically volatile year for global infrastructure, which finished close to where it started but significantly underperformed the broader global share market. A strong November for the asset class was followed up with a solid December — the FTSE Global Core Infrastructure 50/50 (Hedged) Index rose +3.3%, lifting the quarterly gains to +8.5%.

What fund managers are saying….

“The fundamental strength of infrastructure in a higher for longer regime contrasts with the current valuation of listed infrastructure. With infrastructure’s historic lag relative to broad equities in 2023, the asset class screens inexpensive. Historically a ~10% premium asset class, infrastructure is at a ~10% discount today, over a one standard deviation disconnect. This discount has historically preceded strong performance, with infrastructure delivering double-digit returns on average in periods following. Even before considering the prospects for multiple expansion, infrastructure’s total return proposition remains sizable; its ~4% dividend yield and 7% estimated potential income growth are compelling compared to other real assets and to equities more broadly.”

CBRE Investment Management

Fixed Interest

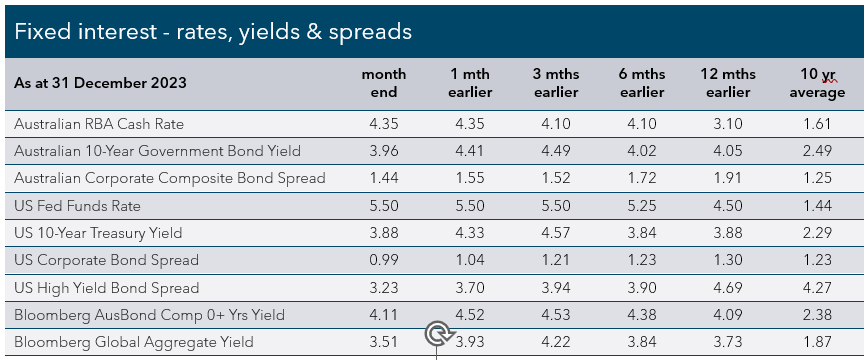

Fixed interest (bond) markets enjoyed another strong month in December and marked their best quarterly performance in some time. The major driver of this performance was a pivot in monetary policy from the Fed from higher-for-longer rates to the prospect of rate cuts in 2024. The Bloomberg AusBond Composite 0+ Yr Index jumped +2.7% in December, lifting +3.8% over the quarter. Global bonds made it two consecutive months of strong performance, with the Bloomberg Global Aggregate Bond Hedged Index advancing +3.0% in December and +5.4% over the quarter.

Government bond yields fell sharply for the second month in a row. Flirting with the level they started the year, the 10-year US Treasury yield ended 2023 at 3.88%, representing drops of 0.45% and 0.69% over the month and quarter. The 10-year Australian Government Bond yield ended December at 3.96%, a fall of 0.45% over the month and 0.53% over the quarter. Shorter-dated government bond yields followed longer-dated yields lower. Two-year US Treasury bond yields dropped 0.50% to 4.23%, while two-year Australian Government Bond yields retreated 0.39% to 3.72% in December. As bond yields fell, bond prices rose, generating another month of strong gains from government bonds. Australian government bonds — as measured by the Bloomberg AusBond Treasury 0+ Yr Index — rose +2.8% and +4.0% over the month quarter, while US Treasuries — represented by the Bloomberg US Treasury Total Return Unhedged USD Index — jumped +3.4% and +5.7%.

The credit (corporate bond) market staged an impressive rally in December as expectations of lower interest rates alleviated concerns about companies facing refinancing and default risk. The Australian investment-grade credit benchmark Bloomberg AusBond Credit 0+ Yr Index jumped +3.2% in December. Global credit made impressive gains, with the Bloomberg Global Aggregate Credit Total Return Index Hedged AUD and Bloomberg Global High Yield Total Return Index Hedged AUD up +6.6% and +3.6%, respectively, over the month. Against the current RBA cash rate of 4.35%, the Australian three-month bank bill swap rate (widely used to set lending rates) was virtually unchanged at 4.36%.

What fund managers are saying….

“While time will tell whether the RBA’s official cash rate rise in November 2023 was the last in the cycle, our view is that we are at or near the peak in cash rates. Peak cash rates are a very exciting prospect for bond investors, particularly now that bond yields have been restored from the very low levels seen since the Global Financial Crisis. Bonds are arguably in better shape now than they have been in a number of years.

If history is a guide, cash rates tend to remain on hold after the peak for an average of eight months and while this is certainly not an exact science, based on what we currently know about the economic outlook and market pricing, we anticipate a period of cash rate cuts (in Australia) toward the end of 2024. “

Jamieson Coote Bonds

What fund Managers are saying…

“As we anticipated, global bond yields are buckling under the weight of softer economic data, decelerating inflation and renewed market expectations of rate cuts across both developed and emerging markets (EM). So what comes next as we head into 2024?

We think global bond yields, led by the US, are poised to move lower even after November’s powerful rally. First, the Fed’s aggressive tightening campaign has likely reached its end with inflation on a decisively downward path. While the US consumer and labour markets have been surprisingly resilient, we don’t see this lasting, and eventually requiring rate cuts to contain a sharper downturn. Second, European and UK growth prospects continue to dim, as the full impact of significant policy tightening to date has yet to be felt. Given growing evidence that inflation in both regions is falling sharply, we believe rate cuts by the European Central Bank (ECB) and Bank of England (BoE) are now on the table for the first half of next year. Third, we expect the US dollar (USD) to depreciate further in the near term as the Fed’s easing cycle gains traction. USD weakness, combined with prospects for rates cuts by the Fed and ECB, should push yields lower across EM local debt markets.”

Western Asset Management

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.