Economic Update November 2023

Monthly Market Update

The highlights:

A stronger-than-expected economy and slower moderation in inflation prompted the Reserve Bank of Australia (RBA) to hike interest rates by 0.25% to 4.35% on Melbourne Cup Day. The United States (US) Federal Reserve (Fed) kept its rates on hold at 5.25%-5.50% at its early November meeting, with many in the market believing this rate hiking cycle is now behind us.

The slide in shares and bonds continued in October, as inflation-friendly economic data and expectations interest rates might remain elevated for an extended period caused government bond yields to surge higher — the 10-year Treasury yield hit 5% during the month for the first time since 2007. Investor sentiment was also impacted by concerns the tragic events unfolding in the Middle East could escalate and spread into a broader regional problem, increasing the oil price further and reigniting inflation.

In stark contrast to the past three months, November started with its best week of the year for share markets as bonds rallied, sending yields lower and raising hopes of a strong end to the year for investors — November and December have historically been two of the better months for shares.

Economic Review

Australia

A higher-than-expected September quarter Consumer Price Index (CPI) reading pointed to stickier inflation and was enough to all but lock in a rate hike from the RBA in its Melbourne Cup Day meeting. The RBA did not disappoint, raising rates by 0.25% to a 12-year high of 4.35% and striking a hawkish (negative) tone with its accompanying statement saying the “risk of inflation remaining higher-for-longer has increased”. The jury is still out on whether there will be another hike in December or if the RBA will wait until its first meeting next year in February.

Annual headline CPI fell from 6% to 5.4%, and core CPI decreased from 5.9% to 5.2%. However, on a quarter-to-quarter basis, higher rent and energy prices actually pushed inflation up from 0.8% to 1.2%, beating the RBA’s own predictions. Consistent with the broader economy, which is showing signs of a modest slowdown from elevated levels, the labour market is displaying glimpses of weakness. The unemployment rate fell from 3.7% to 3.6% in September, but this was due to a drop in the participation rate, with approximately 40,000 full-time positions lost.

US

The US economy continues to display resilience, helped by a strong labour market and robust consumer spending. Core Personal Consumption Expenditure (PCE) inflation — the Fed’s key measure — was 3.7% year-on-year but has been on a downward path since peaking at 5.6% in early 2022. As expected, the Fed kept rates on hold at a 22-year high of 5.25%-5.5% at its early November meeting. It also kept the door ajar for future rises and emphasised it was not thinking about lowering rates right now. A silver lining of the recent spike in bond yields is it potentially reduces the need for the Fed to lift rates further — most US borrowers borrow at fixed interest rates and are more sensitive to moves in longer-term bond yields.

The decision to hold rates was closely followed by a jobs report that confirmed the hot labour market had cooled in October, lifting hopes the Fed was finished with the most aggressive cycle of rate hikes in its history. A smaller-than-expected 150,000 jobs were added in October, and the unemployment rate edged up to 3.9% from 3.8% a month prior, confirming a deceleration in the jobs growth. Wage growth also continues to trend lower, albeit gradually. The US temporary funding agreement is due to end on 17 November and has the potential to put debt-ceiling negotiations back on the agenda.

Europe

In Europe, there is more evidence rapid interest rate hikes and weak Chinese demand for exports have slowed activity, leading to downward pressure on inflation. Flash Gross Domestic Product (GDP) fell marginally compared to the previous quarter, while the composite manufacturing and services Purchasing Manager Index (PMI) also showed the economic downturn had deepened with a three-year low reading of 46.5 — well below a score of 50, which indicates expansionary activity. The annual inflation rate in Europe is expected to fall sharply from 4.3% in September to 2.9% in October, and down significantly from a peak of 10.6% hit 12-months ago.

Against expectations of a slight moderation, headline annual CPI in the United Kingdom (UK) was unchanged in September, while core inflation dropped less than forecast. This all added to concerns the UK may be in line for a long inflation battle, even as the economy slows. The Bank of England (BoE) left rates on hold at 5.25% in its early November meeting.

Asia

The weakening of the yen against the US dollar due to the rise in US bond yields pressured the Bank of Japan (BOJ) to adjust its yield curve control policy further, letting the yield on 10-year Japanese government bonds rise above 1%. Japanese inflation remains resilient but slowed to 2.8% in September. This is still above the BOJ’s 2% target, keeping alive expectations its ultra-easy monetary policy (low rates) will be phased out. Recent indicators pointed to encouraging signs of a stabilising Chinese economy bolstered by government support measures. However, manufacturing activity unexpectedly contracted in October, underlining the difficult task of revitalising growth with the headwinds of protracted property problems and soft global demand.

Asset Class Review

Australian Shares

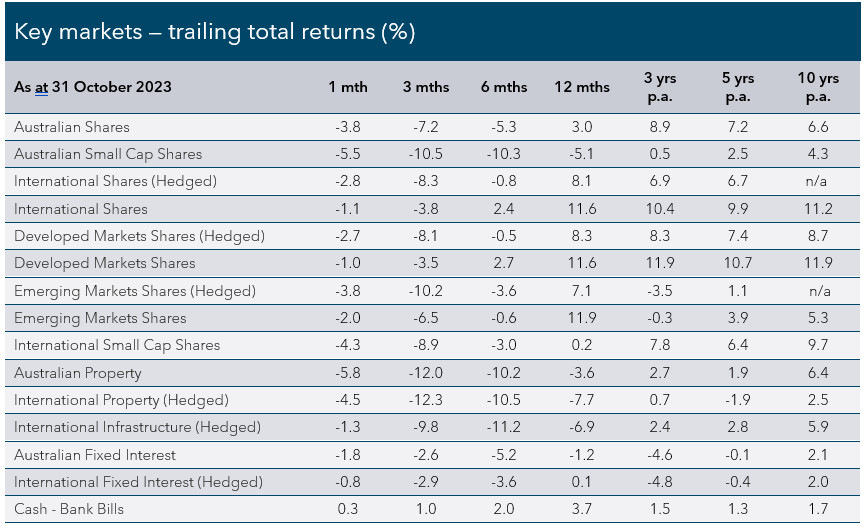

In a third consecutive monthly decline, the S&P/ASX 200 Index ended October down -3.8%, with a spike in geopolitical concerns and a firming realisation interest rates are set to remain higher for longer. Hawkish RBA commentary around its “low tolerance” for a slower return to its inflation target, followed by stronger inflation data, compounded the negative sentiment. Small companies continued to underperform their larger peers, with the S&P/ASX Small Ordinaries Index falling -5.5% in October. High rates have a disproportionate impact on the earnings growth of smaller companies, which have balance sheets more dependent on capital markets, and investors have preferred the stronger balance sheets of higher-quality larger-caps in the current environment. All but one of the sectors were in territory for the month. The worst performers were information technology (-7.6%), healthcare (-7.2%), industrials (-6.4%), and real estate (-6.1%), while utilities (+1.7%) managed to buck the trend, thanks to a surge in the share price of sector heavyweight Origin Energy on takeover activity.

Fund Managers Are Saying:

“The global economy has now left behind the ‘great moderation’ when inflation and interest rates were low, and economic growth stable. Higher interest rates can be expected to bring greater volatility to economies, share markets and individual stocks. This does not mean that investing in a well-managed diversified global equity portfolio isn’t appropriate for many long-term investors. However, the following are worth considering:

Beware of the zombies - companies with just enough operating profit to meet interest payments but insufficient to repay debt or invest in new growth opportunities - are likely to struggle in periods of high interest rates

Look for companies with strong balance sheets - which are less vulnerable to higher interest rates and adverse credit environments

Companies that grow earnings and dividends - through aligning to structural growth trends such as artificial intelligence, decarbonisation, automation, global travel, onshoring or the ageing population - may enjoy greater resilience than those marketing discretionary items to stretched mortgage holders.”

Pengana Capital Group

International Shares

International shares fell in October amid concerns US interest rates would stay higher-for-longer. Geopolitical risks also came into focus, following the attack by Hamas on Israel. Markets have historically overlooked geopolitical events, although a wider regional conflict could impact energy prices and inflation. The MSCI All Country World Hedged Index dropped -2.8%, while unhedged shares were partly insulated by a weaker Australian dollar — the MSCI All Country World Unhedged Index was down only -1.1%. Similar to Australian shares, all sectors moved lower except for utilities (+0.8%). The relative outperformance of information technology (-0.7%) and communication services (-1.9%) sectors, driven by robust earnings results from several of the ‘magnificent seven’, helped to cap broader market losses. Despite a spike in oil prices following events in the Middle East, the oil price ended the month down, dragging energy (-3.9%) companies with it. Consumer discretionary (-4.5%) and healthcare (-4.0%) sectors endured a tough month.

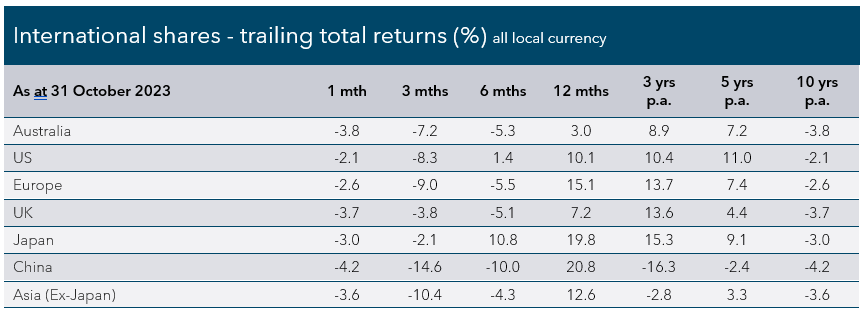

US shares declined in October, with the S&P 500 Index down -2.1% and the Nasdaq off -2.8%. Both markets have dropped more than 10% from their July highs and entered correction territory, albeit temporarily, as markets snapped back in early-November. US company earnings for the September quarter have been solid, with four out of five companies exceeding earnings forecasts, but guidance didn’t prove to be as strong as hoped for, prompting profit-taking from investors. European shares fell with the Euro Stoxx 50 Index off -2.6% as the downturn in the economic community deepened, with only safe haven sectors, utilities and consumer staples making gains. The UK’s FTSE 100 Index fell heavily, dragged -3.7% lower by the banking sector. Emerging markets lagged developed markets, with the MSCI Emerging Markets Index (Hedged) giving back -3.8% as Chinese shares fell on weaker investor sentiment surrounding the country’s economic slowdown.

Fund Managers Are Saying:

“Markets and geopolitics are both unpredictable yet are entwined. As war wages on in Europe, the Middle East has become a new battleground of conflict, and the effects of both weigh on markets. Nobel prize-winning Daniel Kahneman and his colleague, Amos Tversky have shown that people make poor decisions when faced with uncertainty. In markets and geopolitics, uncertainty is the only constant. Successful long-term investors survive short-term volatility by sticking to investment principles that have withstood the tests of time. For portfolios, this may include better diversification. For equities, investing in profitable companies with strong balance sheets and stable earnings has historically given resilience to portfolios. But it’s important to stay the course. We think 2022 and 2023 could become a case study in the rationale for looking beyond the positive and negative commentary and concentrating on long-term goals.”

VanEck Investments

Property and Infrastructure

Rising bond yields again weighed on the interest rate-sensitive listed property sector. The local S&P/ASX 200 A-REIT Index followed a poor September, dropping another -5.8% in October. Global property was also weaker, with the FTSE EPRA Nareit Developed Index (Hedged) falling -4.5%. Although bond yields may be close to peaking, the high cost of capital (borrowing) will continue to impact earnings growth and the ability of listed property companies to grow via developments and acquisitions. Global listed infrastructure posted a negative monthly return with the FTSE Global Core Infrastructure 50/50 (Hedged) Index down -1.3% but outperformed international shares by some margin, with investors attracted to the inflation-hedge characteristics of the asset class.

Fixed Interest

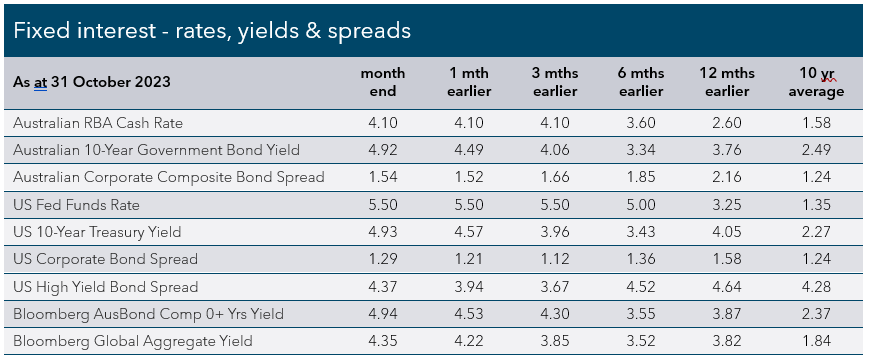

In fixed interest markets, bond yields resumed their upward climb, and bonds sold off in October as investors braced for a prolonged period of higher interest rates. Government bond yields marched higher, particularly at the longer end of the yield curve. The 10-year US Treasury yield breached 5% for the first time since 2007, ending the month up 0.36% at 4.93%. 10-year Australian Government Bond yields experienced an even larger 0.43% move up to 4.92% in response to stickier inflation data. Two-year yields barely moved, with US Treasury and Australian Government Bond yields settling at 5.07% and 4.47%, respectively. Consequently, the local Bloomberg AusBond Composite 0+ Yr Index retreated -1.8% in October, underperforming the Bloomberg Global Aggregate Bond Hedged Index, which retreated -0.8%. Both indices are heavily influenced by the performance of government bonds.

In credit (corporate bond markets), rising government bond yields caused spreads to widen, dragging returns lower. Credit spreads represent the extra compensation, or yield, a corporate bond must pay above the so-called risk-free rate determined by a government bond with a similar maturity date. Australian investment-grade credit fell -0.8% in October. Global investment-grade and high-yield credit declined by -1.2% and -1.0%. The Australian three-month bank bill swap rate (widely used to set lending rates) jumped to 4.35% at the end of October and before the November RBA decision, while longer-dated swap rates point to the possibility of one further cash rate hike.

Fund Managers Are Saying:

“The higher yields in fixed-income, and in credit particularly, are still providing a one in 15-year opportunity for long-term investors to get equity-like returns from credit markets, and likely with much lower risk. Our top-down and bottom-up analysis suggests there is still meaningful net worth, cash flow generation and capital availability to avoid recession. We think the benefits of active management may be undervalued in credit markets given the current environment, especially as defaults are rising and a modest shift in confidence could result in higher equity risk premiums, lower asset coverage, rising defaults and challenge perceptions of how resilient the US economy is to higher real rates.”

Western Asset Management

All financial services included in this communication are authorised by Infinity Financial Consultants, Infinity Financial Consultants Pty Ltd is a Corporate Authorised Representative of Infinity Advisor Australia Pty Ltd ABN 53 636 060 609 AFSL No. 519295. It is general information only and does not constitute financial product advice. If any statements made (either alone or together) constitute advice, then the advice is general advice only and does not take into account anyone’s objectives, financial situation or needs. This document is based on information considered to be reliable. It is based on our judgement at the time of issue and is subject to change. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented in this document. Except for liability that cannot be excluded, Infinity Financial Consultants, its directors, employees, agents, and related bodies corporate disclaim all liability in respect of any error or inaccuracy in, or omission from, this document and any person’s reliance on it. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. If this document contains any performance data, then performance is not a reliable indicator of future performance.